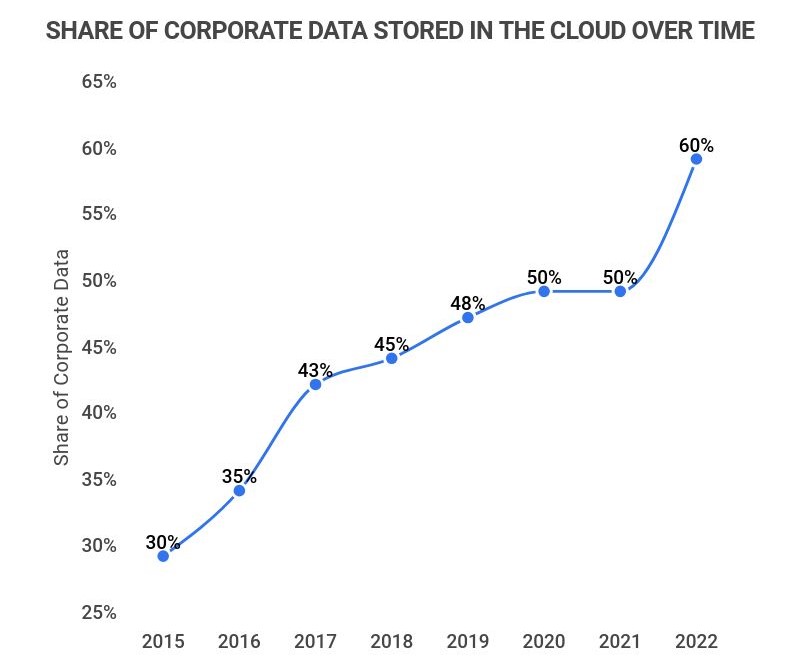

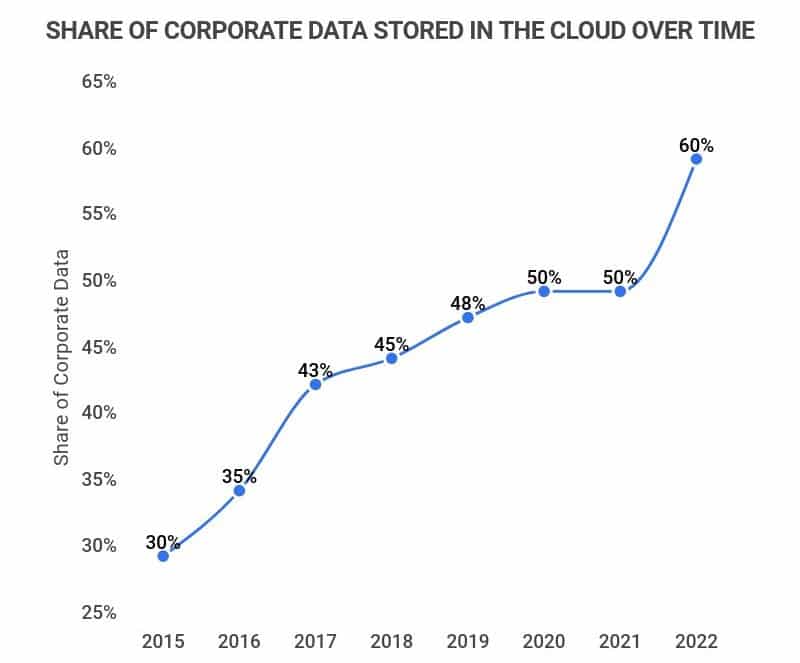

Source: Faction via Zippia

5-7 years ago it seemed obvious that most companies were going to perform huge transformations that included moving most of their applications and data moving to the cloud. The percentage of workloads and data in the cloud was increasing by 5-10 percent per year. However, in 2020 we started to see that slow down before exploding out of the gate again last year. I believe this is an indicator that we’re just entering in to a robust second phase of cloud adoption driven by a fundamentally different approach to cloud.

2010-2017: Cloud Mania

I think the reason for the original slow down in cloud adoption was workloads. The major clouds were initially constructed for green field development and that’s what they attracted. Companies rewrote their e-commerce, web, and mobile applications to take advantage of what the cloud was good at (big dev teams running their own opps). They also bought SaaS platforms that made sense to replace some of the on-premise systems that had become antiquated (for example Email, CRM and HR systems). The companies (Microsoft, Salesforce, Workday) that dominated in this new world of SaaS were able to run systems that looked similar across large numbers of clients.

2018-2021: Rethinking What Workloads are Cloud Workloads

So why did the percentage of workloads start griding to a hault? Simply, we ran out of low hanging fruit. Moving the companies mainframe, ERP, or even just old workloads didn’t make sense. Lift and Shift models provided little value and often actually increased the price of infrastructure. SaaS companies were unable to master things that SAP and others have spent decades building. Companies that were more than a few years old began to see the wisdom of a hybrid cloud model where they could use the cloud for what it was good for and keep the rest on-premise.

2022-???: New Transformation Techniques

What we’re seeing now is innovation from both the cloud providers and service providers that’s making more and more workloads good candidates for cloud. While a full list of these would be difficult, I’ll zoom in on a few that my team at Kyndryl is focusing on helping clients take advantage of:

- Data Platforms – Did you realize that (according to Gartner) Microsoft, Google, and AWS are now all in the “visionaries” category in “Data Science and Machine Learning”? That’s not “Cloud” specific…. that’s just all of Data Science and Machine Learning. They’re quickly catching the capabilities of on-premise focused companies like IBM, Mathworks, and Tibco. The big difference is that when you use a cloud provider for these workloads you are paying with incremental OpEx instead of a big capital investment in software and hardware. That’s making it very attractive for companies that only have a few workloads that they really want to use data science and machine learning for.

- Mainframe Workloads – Mainframes have traditionally been viewed as one big black box that was too dangerous to move to cloud. Kyndryl has been working with companies to setup roadmaps that actually, practically get customers off of on-premise mainframes. Some workloads might get rewritten to be cloud native apps, some might get replatformed so they can run on AWS, others might get moved to Kyndryl’s zCloud.

- ERP Systems in the Cloud – The ERP providers were (for obvious reasons) not the first movers in to cloud. Their customers had extremely mission critical workloads that had been customized to the point of being very brittle. Kyndryl has partnered with SAP and is able to help customers move those workloads now. The patterns have become more hardened and both AWS and Microsoft have programs to help clients. See more in our whitepaper here.